Introduction

Overview of the tax rolls

How to search the tax rolls

Understanding the content of the tax rolls

Land Tax, 1645-1831

Hearth Tax, 1691-1695

Poll Tax, 1694-1698

Window Tax, 1747-1798

Inhabited House Tax, 1778-1798

Shop Tax, 1785-1789

Male Servants' Tax, 1777-1795

Female Servants' Tax, 1785-1792

Cart Tax, 1785-1798

Carriage Tax, 1785-1798

Horse Tax, 1785-1798

Farm Horse Tax, 1797-1798

Dog Tax, 1797-1798

Clock and Watch Tax, 1797-1798

Consolidated Schedules of Assessed Taxes, 1797-1799

Notes on historical language

Related records held by NRS

Further reading

Introduction

The historical tax rolls from the late 17th to the early 19th centuries include taxes on houses, windows, servants, carriages, carts, horses and dogs. They are from the Exchequer records held by the National Records of Scotland (NRS). The Exchequer is one of the earliest government departments which developed out of the King's Chamber. It was the branch of the royal household which oversaw the royal finances at a time when Scotland was an independent kingdom. The chief financial officer was the King's Great Chamberlain. The Exchequer was not a permanent body, meeting only to audit the accounts of the sheriffs and other collectors of royal revenues.

Until the 17th century, taxes were viewed as an extraordinary source of revenue and levied for specific purposes such as the defence of the realm. The burden of taxation originally fell on the land and property owned by the barons, burghs and the Church. However, by the end of the century, the government sought to broaden the tax base by taxing other forms of property.

In 1690, Parliament granted a tax of 14 shillings on every hearth (fireplace) in the kingdom, payable by both landowners and tenants to raise money for the Army. Land Tax rolls (often called cess rolls or valuation rolls) were compiled by the Commissioners of Supply in each county to enable the collection of the Land Tax from 1667 onwards. Poll taxes were imposed in the 1690s to pay off the debts due to the country and arrears of the Army and Navy.

After 1748, certain assessed taxes were levied in Scotland. The Window, Commutation, Inhabited House and Consolidated Assessed Taxes were all taxes on householders, though in practice only the better off were taxed. In the case of the Window Tax, the house had to have at least seven windows or a rent of at least £5 to be taxed. The war with France, from 1793 onwards, resulted in the extension of taxation to other forms of property and imposed additional duties on those already taxed. The records of each tax are organised by county and parish with royal burghs listed separately.

Overview

There are 15 different types of tax rolls available to search on Scotland’s People. To provide a brief overview, these have been divided into two tables below. The first table lists the tax rolls imposed pre-Union, i.e. before the union of the English and Scottish Parliaments in 1707. The second table lists the assessed tax rolls levied post-Union. The tax rolls are arranged chronologically, with their covering dates and NRS reference numbers.

Their content and usefulness for historical research is discussed in more detail in this record guide in the section Understanding the content of the tax rolls.

Pre-Union tax rolls

| Name of tax | Brief description of tax | Covering dates | NRS reference |

|---|---|---|---|

| Land Tax | Lists the names of owners of landed estates and assess the rental value of their lands. | 1645-1831 | E106 |

| Hearth Tax | The names of landowners and tenants who were liable for tax on hearths (including kilns). | 1691-1695 | E69 |

| Poll Tax | List the names of all adults, except those dependent on charity, who were liable for tax. | 1694-1695 and 1698 | E70 |

Post-Union assessed tax rolls

| Name of tax | Brief description of tax | Covering dates | NRS reference |

|---|---|---|---|

| Window Tax | Lists the names of householders, number of houses and number of windows in houses with seven or more windows. | 1747-1748 and 1798 | E326/1 |

| Inhabited House Tax | The names of householders and annual value of houses. | 1778-1798 | E326/3 |

| Shop Tax | The names of the shopkeepers and the annual value of shops over £5. | 1785-1798 | E326/4 |

| Male Servants' Tax | This tax was imposed on certain categories of employed or retained male servants. They list names of masters or mistresses, names of servants and sometimes their jobs. | 1777-1798 | E326/5 |

| Female Servants' Tax | Lists the names of masters or mistresses, names of servants and sometimes their jobs. | 1785-1792 | E326/6 |

| Cart Tax | The names of owners and numbers of two, three or four wheeled carts. | 1785-1798 | E326/7 |

| Carriage Tax | The names of owners and number of two or four wheeled carriages. | 1785-1798 | E326/8 |

| Horse Tax | The names of owners and number of carriage and saddle horses. | 1785-1798 | E326/9 |

| Farm Horse Tax | The names of owners and number of horses and mules used in husbandry of trade. | 1797-1798 | E326/10 |

| Dog Tax | The names of owners and number of non-working dogs. | 1797-1798 | E326/11 |

| Clock and Watch Tax | The names of owners and number of clocks, gold watches and silver or metal watches. | 1797-1798 | E326/12 |

| Consolidated Schedules of Assessed Taxes | Lists the names of householders, value of houses, number of windows, male servants, carriages, horses and dogs. | 1798-1799 | E326/15 |

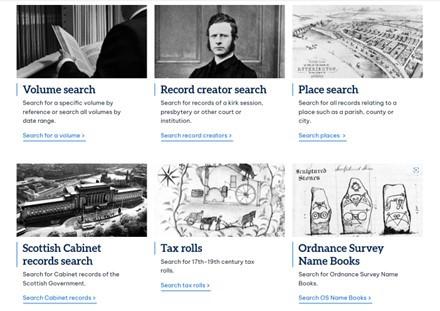

How to search the tax rolls

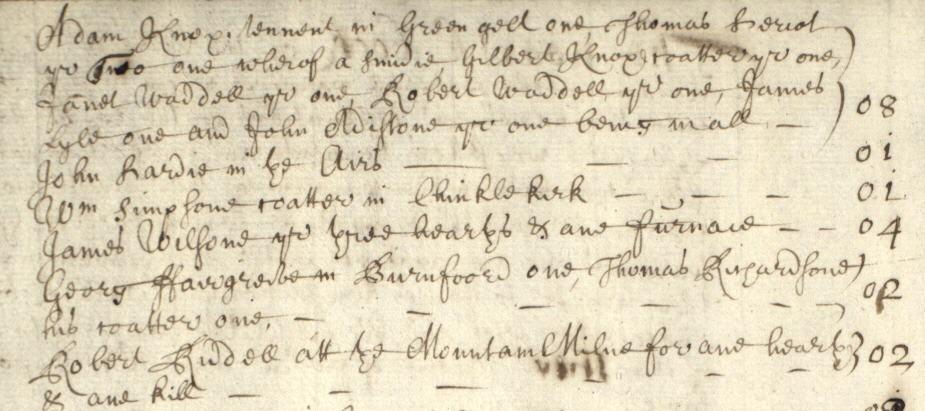

Tax rolls can be searched and viewed within the Virtual Volumes area of the Scotland’s People website. For further information please read our guide on using Virtual Volumes. The tax rolls search area can be used to search and view volumes, as well as to search plain text transcriptions of the records.

Crown copyright, NRS

Search form

You can search the tax rolls using some or all of the following index fields:

- Record type (a list of types of tax roll)

- Year range (Year from/Year to)

- Place name (to search for a county, burgh, city, etc.)

- Transcription search (this will search plain-text transcriptions of the volumes)

- Reference (if you know the NRS archive reference for the volume you require)

Crown copyright, NRS

The tax rolls have descriptions which include the relevant counties or administrative areas (for example, parishes, presbyteries, etc.) for each volume. By entering a search term into the ‘Place search’ field you can search for tax rolls from a particular county, burgh, city, etc.

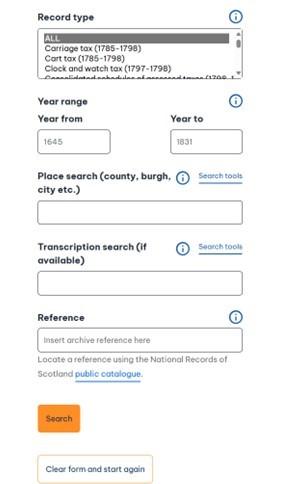

The text in many of the tax rolls has been fully transcribed. Transcriptions are not available for the Window Tax, Inhabited House Tax and the Consolidated Schedules of Assessed Taxes. The transcription is a plain text version of the manuscript or printed text found in the image. These transcriptions were captured over a number of years as a volunteer project. It is acknowledged that these are not 100% accurate, but they are provided as a useful finding aid for researchers. You can use the ‘Transcription search’ field to search the transcriptions for specific keywords such as an individual name or other term. Entering a keyword or phrase in the ‘Transcription search’ field will return a set of results arranged by record type, as shown below.

Crown copyright, NRS

Any search without a term in the ‘Transcription search’ field will return a list of volume results. Any search which does include a term in the ‘Transcription search’ field will return a set of results arranged by record type as shown above.

Please note that if you include a term in the ‘Place search’ field, you cannot search using the ‘Transcription search’ field and vice versa. For both these fields you can use the search tools option to tailor your results to include any word in your search, all words or an exact phrase.

When viewing a tax roll, you can use the ‘Volume contents’ list in the image viewer to jump to a relevant point in the volume. The contents list appears when you click on the tab ‘Volume contents’ on the navigation bar. It marks the start of each section in the volume. For tax rolls this is usually an area name.

The search form includes search tips for each field with links to more detailed research guides where appropriate.

Male and female servant tax rolls

These tax rolls have been indexed which means they can be searched using the servant tax rolls (male and female) search. You can use this to easily search for individuals by name.

How to search servant tax rolls index

Go to "Search the records > Tax records > Servant tax rolls". Search on some or all of the following index fields:

- Surname

- Forename

- Master/Servant/Both

- Tax type

- County

- Parish

- Burgh

- Description (place, occupation, title)

- Year from/Year to

The search form includes tips for each field with links to more detailed research guides where appropriate.

When searching the indexes, please be aware that the spelling of a surname or forename might not be as you expect.

Surnames are captured as they are given on the tax rolls. Reasons for a surname not appearing as expected include:

- Mis-spelling, phonetic spelling or other misinterpretation by an assessor;

- Surname variants;

- Surnames of noble families are often different from the names in their titles. For example, the surname of the Dukes of Buccleuch is Montague Douglas Scott, but it is more likely that the title will appear in the surname field than the family name. In this example, Buccleuch would appear in the surname field and Duke will appear in the forename field, with Montague Douglas Scott not necessarily recorded in any of the fields.

Forenames are captured as they are given on the tax rolls. Reasons for a forename not appearing as expected include:

- Misspelling, phonetic spelling or other misinterpretation by an assessor.

- Forename variations, including abbreviations (for example, William, Wm., Willm) and use of diminutives (for example, Margaret, Maggie, Meg, Peggy), nicknames, or middle names as first names.

When searching for businesses (for example, John Brown and Sons), groups of people (for example, Ladies of Traquair) or occupational titles (for example, Lord Advocate or Solicitor General) please search for these in the Surname field.

Understanding the content of the tax rolls

Pre-Union tax rolls

Land Tax, 1645-1831, NRS, E106

Land Tax rolls (often called cess rolls or valuation rolls) were compiled by the Commissioners of Supply in each county to enable the collection of the Land Tax from 1667 onwards.

They list the owners of landed estates and assess the rental value of their lands. Rolls were compiled or revised at irregular intervals. The date of a roll is taken to be that on which the valuation was made or revised, but in many cases the surviving copy of the roll was made at a much later date, which is established by the certificate of the Commissioners of Supply, their clerk or the collector, authenticating it.

The records span from 1645 to 1831, but most date from after 1700. They are arranged by county and parish. Sometimes, no personal names are given in the records, or only the biggest landowners are named. For example, ‘Robert Arbothnot of Katerlane for himselff and remnant heritors’ (NRS, E106/1/2). However, occasionally tenants are named in the description of lands. For example, ‘That part of Old Mains posest by Jas Forsyth’ (NRS, E106/14/2).

If you are fortunate to find the name of a proprietor of interest, you may be able to find further records in the Register of Sasines held by NRS or estate records held by NRS or a local archive.

Additional information about NRS records can be found by consulting the NRS Online Public Catalogue. They can be viewed, by prior appointment, in the NRS Historical Search Room at General Register House, Edinburgh.

Other Land Tax rolls can be found among Commissioners of Supply records in local archives. You can locate contact details via a Scottish Archives map on the Your Scottish Archives website.

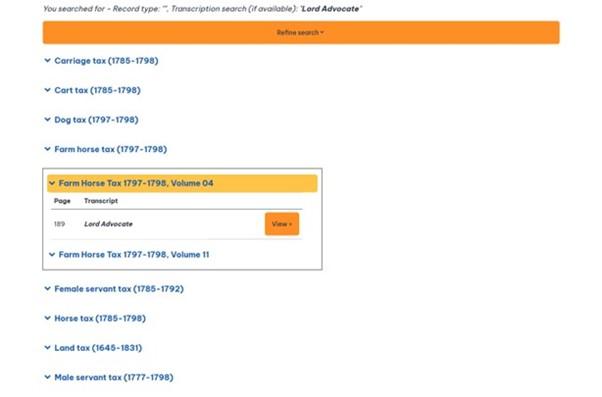

Hearth Tax, 1691-1695, NRS, E69

Hearth Tax rolls list the people who were liable for tax on hearths (including kilns) in Scotland in the 1690s. Heads of households of each building were liable for a tax of 14 shillings, payable at Candlemas 1691 (2 February), and only hospitals and the poor were exempt.

There were huge difficulties in collecting the tax, particularly in the Highlands, and attempts to collect the tax went on in some parts of Scotland until 1695. The surviving Hearth Tax rolls are generally arranged by county and then parish or by landed estate.

The lists of hearths are more useful than accounts of hearth money collected, which may omit personal names. When you consult a list or account for a particular parish, there will be a list of those who had hearths in their houses. Sometimes, just the name of the hearth-owner is given without their designation. For example,

‘W[illia]m Simpsone coatter in Chinklekirk 01

James Wilsone th[e]r[e] three hearths & ane furnace 04’

NRS, E69/5/1, page 2.

Crown copyright, E69/5/1, page 2

The rolls for the following counties contain lists of householders (some arranged by estate, place or presbytery): Angus, Ayr, Argyll (but with some areas missing), Bute, Berwick, Clackmannan, Dumbarton, East Lothian, Fife, Kincardine, Lanark, Midlothian, Perth, Renfrew, Roxburgh, Stirling, Sutherland, West Lothian and Wigtown. The rolls for the counties of Aberdeen, Banff, Dumfries, Kirkcudbright, Moray, Nairn, Peebles and Selkirk give only the total number of hearths surveyed and money collected in each parish or estate.

The roll for Inverness-shire consists mainly of a summary of a small number of parishes without listing inhabitants but includes a list of burgesses or inhabitants of the town of Inverness and a list of poor in the parishes surveyed.

There are no tax rolls for Orkney, Shetland, Caithness, Ross and Cromarty in these Exchequer records.

Additional Hearth Tax records held by NRS

In addition to the records available on Scotland’s People, a few Hearth Tax records survive among collections of private papers in NRS. The papers of the Leslie family, Earls of Leven and Melville, NRS, GD267/300-391, contain the papers of James Melville of Cassingray, collector of hearth money, 1690-1707. These supplement the Exchequer Hearth Tax rolls for various parishes in Argyll and Bute, Dunbartonshire, Dumfriesshire, Edinburgh, in Dumfriesshire, Fife and Shetland.

Lists for parishes in Ross-shire are in the papers of the MacKenzie family, Earls of Cromartie, NRS, GD305/1/164/238-269 (items 240-243) and NRS, GD305/1/164/270-295 (items 271-2, 277, 280-1.)

Further information about these records can be found by consulting the NRS Online Public Catalogue. They can be viewed, by prior appointment, in the NRS Historical Search Room at General Register House, Edinburgh.

Poll Tax, 1693-1698, NRS, E70

Poll taxes were imposed on Scotland in 1694, 1695 and twice in 1698 to pay off the debts due to the country and arrears of the Army and Navy. Payment was graduated at the rate of six shillings and upwards according to rank and means; only the poor and children under 16 were exempt. The collectors of the Poll Tax faced similar difficulties to those of the hearth tax and the records are incomplete.

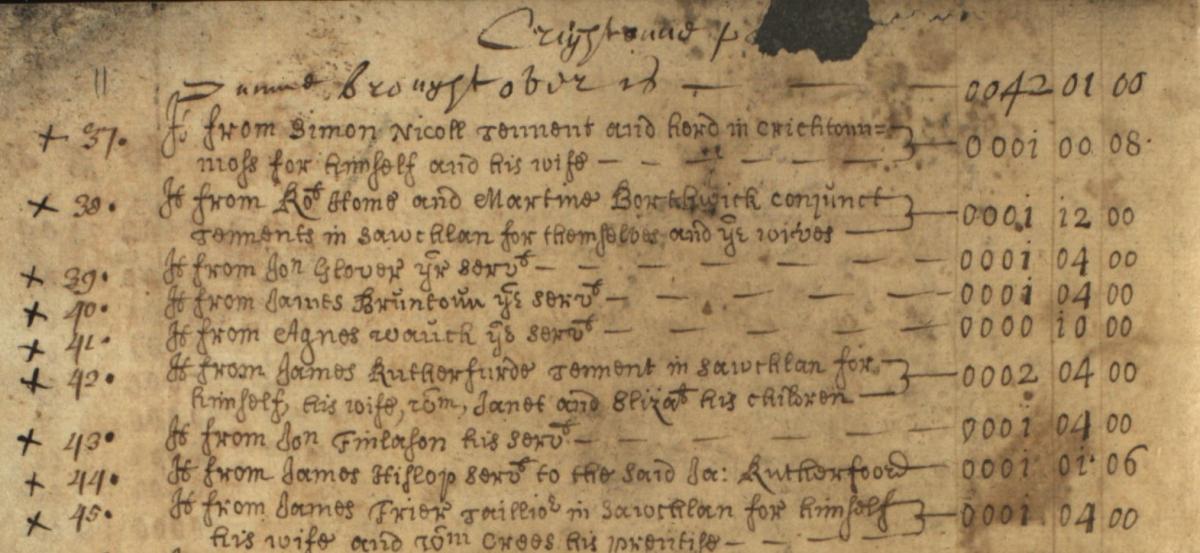

Arranged by county and parish, the amount of information provided varies from list to list. Some include names of children and servants. For example, the Poll Tax roll for Crichton parish records ‘James Rutherfurde Tennent in Sawchtan for himself, his wife, Wm, Janet and Eliza[be]t[h] his children’. (NRS, E70/8/1, page 11).

Crown copyright, NRS, E70/8/1, page 11.

An overview of the surviving Poll Tax records have been listed in two tables below: the first table lists those records available to search on Scotland’s People and the second lists additional Poll Tax records held by NRS. The Poll Tax rolls are arranged alphabetically by place, with their covering dates and NRS reference numbers.

Poll Tax records available on Scotland’s People

| Place | Description | NRS reference |

|---|---|---|

| Ayrshire | 1698/1699. | E70/1 |

| Berwickshire | Lauder parish only, 1698. | E70/2 |

| East Lothian | Direlton parish only, 1698. | E70/3 |

| Edinburgh, Canongate and Leith | 1694-1698. | E70/4 |

| Fife | 1698-1699. | E70/5 |

| Inverness-shire | 1699. | E70/6 |

| Lanarkshire | 1695-[1700]. | E70/7 |

| Midlothian | 1694-1695. | E70/8 (see also E70/4) |

| Nairnshire | 1698-1699. | E70/9 |

| Orkney | Kirkwall parish only, 1698. | E70/10 |

| Perthshire | 1698-1699. | E70/11 |

| Renfrewshire | 1694-1696. | E70/12 |

| West Lothian | 1694-1696. | E70/13 |

| Wigtownshire | 1699. | E70/14 |

Additional Poll Tax records held by NRS

| Place | Description | NRS reference |

|---|---|---|

| Aberdeenshire | Aberdeenshire parishes 1694 (Kearn only) and 1698. | GD52/6-8 |

| Argyllshire | Argyll parishes, 1698-1699 are in Inveraray Sheriff Court records. | SC54/20/1 |

| Berwickshire | 1695. | GD86/770A and GD158/679 |

| Fife | Copies of a 1696 list for the parish of Anstruther Wester and St Andrews. | RH2/1/68 |

| Orkney | 1693-1696. | RH9/15/175 |

| Perthshire | Errol parish only, 1696. | GD316/10 |

| Perthshire | Dunning parish only, 1696. | GD56/128 |

| Selkirkshire | Selkirk burgh and parish, 1694-1695. | GD178/6/1-3 |

For those records not available on Scotland’s People, further information can be found by consulting the NRS Online Public Catalogue. They can be viewed, by prior appointment, in the NRS Historical Search Room at General Register House, Edinburgh.

Post-Union assessed tax rolls

Window Tax, 1748-1798, NRS, E326/1

The Window Tax was levied on the occupants of buildings with several windows in Scotland from 1748 until 1851. The records survive for the period 1748-1798 and list the householders and the number of windows in their properties (the Window Tax had been imposed in England from 1696).

They are arranged by county and royal burgh and there are some gaps for particular years for some counties and burghs. The usefulness of these records for research is limited, as only those with more financial means were taxed. Initially the rolls list properties with ten or more windows but from 1762 onwards they list those with eight or more windows. From October 1766, they list those with seven or more windows or a rent of at least five pounds yearly.

In some rural areas, the only people liable for tax were the minister and lairds. The records for burghs and some more populous parishes can be useful in listing more names, but this is limited by the omissions of designations and locations of the dwelling houses.

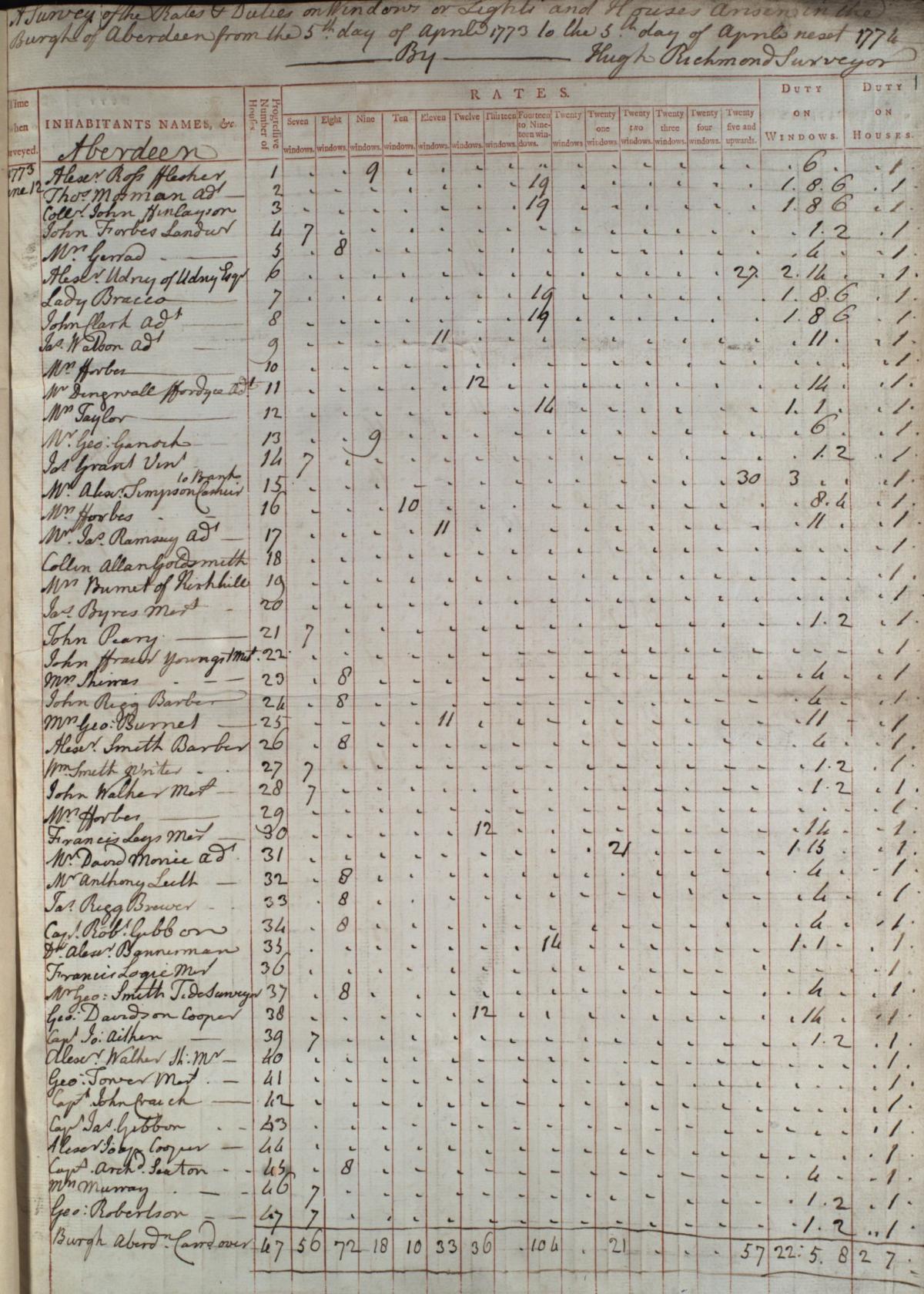

For example, the Window Tax schedule for Aberdeen burgh in 1773 lists 546 inhabitants paying Window Tax, but they include five people described as ‘Mrs Forbes’, with three of them listed on the first page (NRS, E326/1/128).

Crown copyright, NRS, E326/1/128, page 1

Inhabited House Tax, 1778-1798, NRS, E326/3

This tax was first imposed in 1778 and the resulting tax schedules were bound by counties, with royal burghs included under their respective counties. An exception is the burgh schedules for 1786-1787 and 1789-1790. These were found several years after the original arrangement was made and have been bound in alphabetical order for each year (NRS, E326/63-64). The schedules for 1793-1794, 1795-1796 and 1796-1797 have not survived, except for the 1793-1794 schedules for Inverness-shire and Inverness burgh.

In these tax rolls you can find the names of householders and annual value of houses, but the initial assessment was on houses with an actual or notional rental value of at least five pounds per annum. There was a sliding scale of duty for houses valued between five pounds and 19 pounds, between 20 pounds and 39 pounds and 40 pounds or over. Mostly for rural areas, only a handful of individuals were liable for tax in each parish. However, for researchers interested in inhabitants of the prosperous towns during the 'Age of Improvement' the Inhabited House Tax schedules are a valuable source of information.

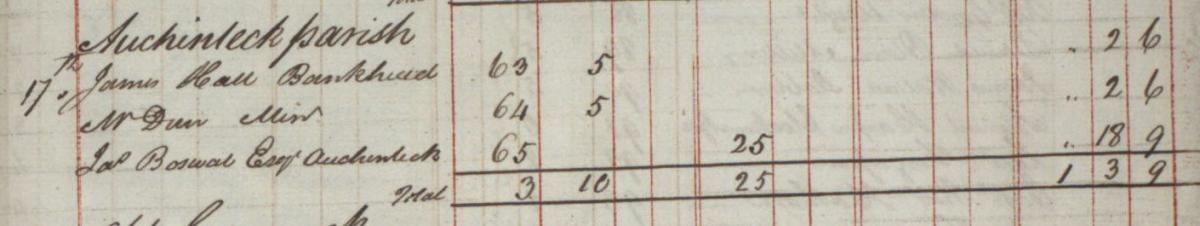

In the 1783 schedule for Ayrshire, the celebrated Scottish author, James Boswell, is listed as one of three people in Auchinleck parish liable for the tax. He had become the 9th laird of Auchinleck shortly before this. In the schedule Auchinleck House was assessed as having a rental value of 25 pounds and was liable for 18 shillings and 9 pence in Inhabited House Tax.

Crown copyright, NRS, E326/3/4, page 73

After 1798 this duty was incorporated in the Consolidated Schedules of Assessed Taxes.

Shop Tax, 1785-1789, NRS, E326/4

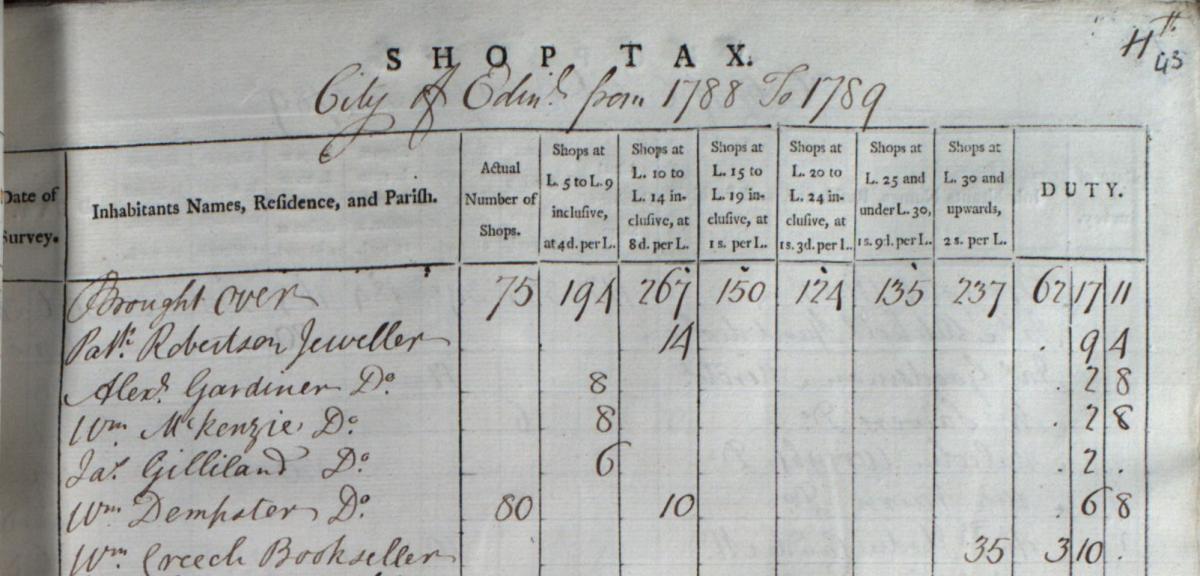

These records contain the names of the shopkeepers throughout Scotland in the late 18th century for shops which had an annual value of over five pounds. Occasionally the names of the businesses are included. The Shop Tax for Edinburgh includes an entry for ‘W[illia]m Creech Bookseller’ (E326/4/8, page 43). His was one of the larger shops in Edinburgh, which meant he paid one of the highest taxes of three pounds and ten shillings.

Crown copyright, NRS, E326/4/8, page 43

Male Servants’ Tax, 1777-1798, NRS, E326/5

The male servant tax was levied on the households employing 'non-essential' male servants from 1777 onwards. This excluded farm labourers, industrial workers and servants in businesses like shops and inns. The tax was aimed primarily at the wealthy in town and country who could afford domestic or personal servants (such as cooks, butlers, valets, grooms, gardeners and coachmen).

The tax schedules (NRS, E326/5) cover the years 1777-1779, 1785-1795 and 1797-1798 and are divided county by county and then by parish and household, with separate volumes for the royal burghs. The parish and burgh schedules are arranged by household, listing the name of each household liable for the tax and usually the name and designation of each servant.

Female Servants’ Tax, 1785-1792, NRS, E326/6

Taxes were also levied on households employing 'non-essential' female servants between 1785 and 1792. Most of the servants listed were engaged in domestic work. The tax schedules are divided county by county and then by parish and household, with separate volumes for the royal burghs. The parish and burgh schedules are arranged by household, listing the name of each householder liable for the tax and usually the name and designation of each servant.

Cart Tax, 1785-1798, NRS, E326/7

This tax fell mainly on farmers and landowners in the rural areas and carters in the towns. Cart Tax rolls list the names of owners of two, three, or four-wheeled carts and the types of cart they owned, as well as the duty paid in tax.

Carriage Tax, 1785-1798, NRS, E326/8

This tax was levied on the owners of two or four-wheeled carriages. In these rolls, you will find the names of the carriage owners, the types of carriage they owned, as well as the duty paid on tax.

Horse Tax, 1785-1798, NRS, E326/9

These rolls provide information on those who paid taxes on carriage and saddle horses.

Farm Horse Tax, 1797-1798, NRS, E326/10

These rolls list the names of owners and number of horses and mules used in husbandry or trade in 1797-1798. It is useful for research purposes as it can help identify tenant farmers. In some rolls, the tax inspectors made repeat visits to track down non-payers, which explains why some parishes and burghs are repeated. The Farm Horse Tax is continued in the Consolidated Assessed Taxes, 1798-1799, NRS, E326/13, which are described below.

Dog Tax, 1797-1798, NRS, E326/11

A tax of five shillings on non-working dogs was levied from 1797-1798. They provide information about owners of non-working dogs in Scotland and the number of dogs they owned. The tax rolls do not list the dogs’ names.

Clock and Watch Tax, 1785-1798, NRS, E326/12

These rolls list the names of owners and numbers of clocks and the gold, silver or metal watches they owned. Unfortunately, the volume containing the counties of Midlothian, Moray, Orkney, Peebles, Perth, Renfrew, Ross, Roxburgh, Selkirk, Shetland, Stirling, Sutherland, West Lothian, and Wigtown has not survived.

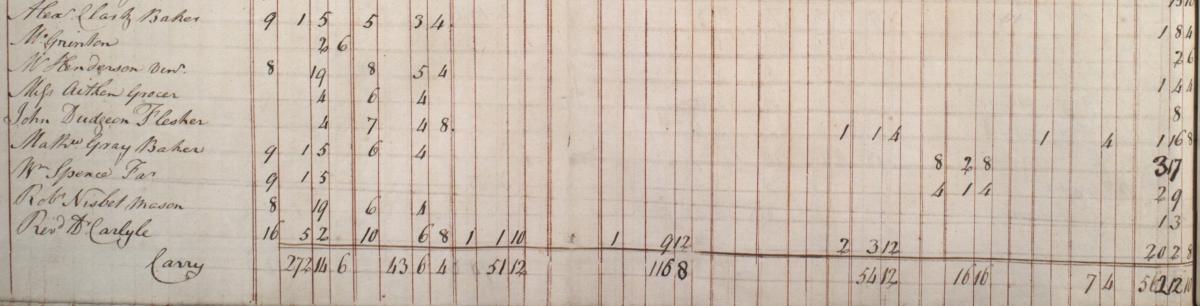

Consolidated Schedules of Assessed Taxes, 1798-1799, NRS, E326/13

From 1787 taxes were payable to a single consolidated fund. These were entered on a single schedule, which included houses and windows, inhabited houses, male servants, carriages, riding and carriage horses, horses used in husbandry and trade and mules, and dogs. The consolidated schedules survive for the year 5 April 1798 to 5 April 1799 but only for counties which begin with the letters A-M. The county schedules for Nairnshire, Renfrewshire, Roxburghshire, Ross-shire, Selkirkshire, Stirlingshire, and Wigtownshire have not survived.

The Reverend Dr Alexander Carlyle, friend of David Hume and Adam Smith, is listed as one of the people in Inveresk parish liable for the tax. The schedule reveals that he had to pay, amongst others, for 16 windows, one male servant, one carriage and two horses.

Crown copyright, E326/15/20, page 150

Notes on historical language

The schedules (rolls) of taxation on female and male servants were created in the 18th century. Terms and language from this historical context are present in the records, which reflects the attitudes and biases of the time. These records can be searched with a name index in the ‘People’ search area, or can be browsed with searchable transcription data in Virtual Volumes. Plain text transcriptions of the manuscript or printed text in the original records (also the basis of the name indexes) may contain historical language which is no longer considered accurate or acceptable.

Related records held by NRS

The NRS research guide to Scottish Taxation Records lists all taxation records held by NRS. Please note that the dates given are covering dates; there may be some gaps in the records.

For those records not available on Scotland’s People, further information can be found by consulting the NRS Online Public Catalogue. They can be viewed, by prior appointment, in the NRS Historical Search Room at General Register House, Edinburgh.

Further reading

You can read more about tax rolls in our feature article Historical tax rolls: a window into the past.

If you are new to reading and interpreting historical tax rolls, you can find help in our guide to reading older handwriting, the Scottish Handwriting resource and a glossary of abbreviations, words and phrases.

Adamson, Duncan, ‘West Lothian Hearth Tax 1691 with county abstracts for Scotland’ (Scottish Record Society, 1982) includes useful information on the deficiencies of the hearth tax lists.

NRS research guide to Scottish Taxation Records.

The National Archives (TNA) guide to Taxation for records held by TNA and online resources.

Timperley, Loretta R., ‘A Directory of Land Ownership in Scotland c. 1770’ (Scottish Record Society, 1976).

‘Tracing Your Scottish Ancestors The Official Guide: 7th Edition’, National Records of Scotland (Birlinn, Edinburgh, 2020). Available to purchase via the Scotland’s People Shop.

Urquhart, Robert H J and Close, Rob, 'The Hearth Tax for Ayrshire' (Ayrshire Federation of Historical Societies, 1998).

Wood, Marguerite, 'Edinburgh Poll Tax Returns for 1694' (Scottish Record Society, 1951).